Problematic Situation

The wave of technological innovation that has spread rapidly in the last two decades has radically changed various life areas. As a result, economies are progressing to a development model increasingly focused on the use of information and communication technologies (ICT), and it becomes crucial to take advantage of the new opportunities for economic activities that the digital ecosystem offers. One of the latest technologies that have changed the way of doing business is e-commerce. Nevertheless, its implementation has encountered multiple challenges that limit its full use.

E-commerce can be defined as (Fredriksson, 2017):

The sale or purchase of goods or services conducted over computer networks by methods specifically designed for the purpose of receiving or placing of orders. This includes that payment and delivery do not have to be conducted online; and orders made by telephone calls, fax, or manually typed e-mail are excluded. E-commerce can be between Business-to-business (B2B), Business-to-consumer (B2C), Consumer-to-consumer (C2C), and Government-to-business (G2B).

According to the UNCTAD B2C E-commerce Index 2019, El Salvador has a disadvantageous position compared to the rest of the world’s countries in preparing its economy to support online shopping. Thus, El Salvador ranks #110 out of 152 countries evaluated and only achieves a score of 37.2 out of 100 possible, below the average score for Latin America and the Caribbean (48.0 points) (UNCTAD, 2019). In El Salvador, e-commerce has encountered multiple structural challenges due to the economic, social, and technological reality. First, the Salvadoran economy is primarily informal. Although there is no exact data, it is estimated that the informal sector represents close to 60% of the economy (UNODC, 2020), limiting the level of regulation and control that the government can apply to these economic activities. Besides, the context of crime and violence in the country significantly affects economic activities. The economic cost of violence represents 18% of the GDP, the 16th highest among 162 world-wide (Institute for Economics & Peace, 2020), including the distrust on the online exchange of products and services. Moreover, El Salvador has a low level of technological development. This article will carry out more in-depth analysis by evaluating through a matrix the implementation of e-commerce in El Salvador based on quantitative and qualitative criteria. The areas evaluated will be: Access to Linked Services, Regulatory Framework, Infrastructure and Logistics, and Business capabilities.

Matrix for technology assessment of the implementation of e-commerce in El Salvador

- Access to Linked Services

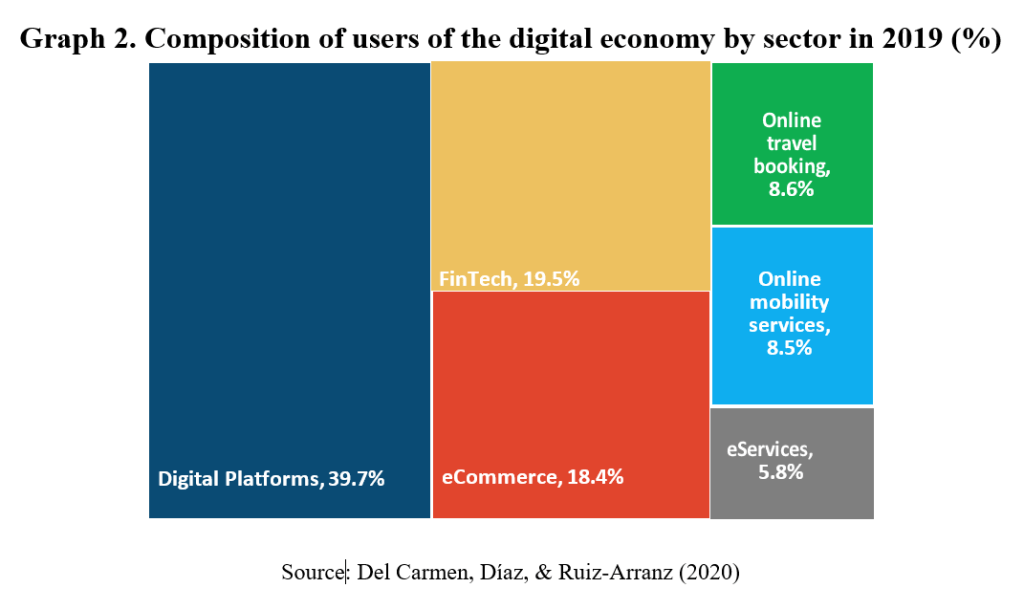

Internet Access and E-commerce Users. The rate of penetration of Internet access in Salvadoran households has been slow (Graph 1). Nowadays, only 23.4% of households have internet access, and in the rural area only 4.1% of households have this service versus 34.6% in the urban area (DIGESTYC-MINEC, 2020).The low level of internet penetration limits the exchange of good and services Business-to-business (B2B), Business-to-consumer (B2C), and Consumer-to-consumer (C2C). On the other hand, among Salvadoran users of the digital economy, e-commerce is the third sector with the largest users (18.4%), as shown in Graph 2 (Del Carmen, Díaz, & Ruiz-Arranz, 2020). Moreover, the lack of access to this service, which is already said to be considered a basic service, is a barrier to accessing goods and services that improve the population’s quality of life and can promote social exclusion.

Financial Inclusion. In 2015, El Salvador approved the Law to facilitate Financial Inclusion. Its objective is “to promote financial inclusion, promote competition in the financial system, as well as reduce costs for users and clients of the referred system” (SSF, 2015). Thus, “subsequent efforts have expanded access to financial services through the introduction of electronic money providers, electronic wage payments, and larger agent networks” (The Economist Intelligence Unit, 2019). However, it is estimated that only 30.4% of Salvadoran adults have a formal banking service (World Bank Group, 2018). For electronic commerce, financial inclusion is critical because it allows making and receiving electronic payments.

Use of Digital Banking. A recent study reflected that “44% of Salvadorans prefer to make their payments and transfers personally using cash, regardless of whether they have a bank account” (Pastrán, 2019). Thus, the Salvadoran population still does not feel completely confident and willing to make electronic payments. Promoting digital banking use in El Salvador can be accompanied by projects on financial education to train the population on the advantages of electronic payments.

2. Regulatory Framework

Regulation of E-commerce. In 2019, El Salvador approved the Electronic Commerce Law, the objective of which is to “establish a legal framework for electronic relationships of a commercial, contractual nature, carried out by digital, electronic or technologically equivalent means” (Asamblea Legislativa, 2019). However, the President of the Republic returned this law to the Salvadoran Congress because aspects such as electronic payments, cross-border transfers of information, cybersecurity, artificial intelligence, institutional cooperation, dispute resolution, definitions of important actors, data protection were left out.

Regulation of Consumer Protection. El Salvador has made reforms to the Consumer Protection Law, to include aspects of electronic commerce of goods and services. Thus, the protection of personal information, the reversal of payments in the event of consumer complaints or returns, and frameworks for privacy notices, terms, and conditions of the site were included (Barrera, 2020). These reforms are expected to protect consumers against misleading advertising and guarantee the privacy of their data.

3. Infrastructure and Logistics

Logistics Efficiency. El Salvador ranks #101 out of 160 in the 2018 Logistics Performance Index and its score is behind the average of Latin America and Caribbean, as show in Appendix 3 (World Bank, 2018). This disadvantageous competitive position hinders online order delivery systems with efficiency and quality, both in times and costs. According to this index, the main weaknesses of El Salvador, in comparison to the rest of the countries evaluated, is the efficiency of customs clearance and border management (#120), the ability to track and trace shipments (#117), and the quality of trade and transportation infrastructure (#114). Typically, consumers must wait 2 or 3 days to receive their local order, and between 15 and 30 days in international purchases, and the costs are usually considered high (Urquilla, 2021).

4. Business Capabilities

Knowledge of Digital Marketing. According to the 2017 National Survey of Micro and Small Businesses, 89.8% of the surveyed companies stated that they had not received any technical assistance, only 8.7% stated that they had received it. Of those who have been trained, 39.9% expressed that it was by private entities, 32.1% by public entities, 7.8% by the National Commission for Micro and Small Enterprises, 5.5% by private universities, 5.0% by NGOs, and 4.5% by local governments. Besides, 30.6% of the businesses expressed their need for training, while 69.2% expressed that they do not have this need. Among the companies that expressed that they need training, the main topic was marketing and business plan (38.8%) (CONAMYPE, 2018). From these results, it can be inferred that the lack of knowledge and skills in marketing, mainly digital, limits SMEs’ ability to be successful in electronic commerce. Moreover, the articulation of efforts between the different actors to strengthen SMEs’ marketing capacities is still a challenge for El Salvador.

Use of Online tools in SMEs. When asking about SMEs’ internet tools, the 2017 National MYPE Survey found that 76.1% of companies did not use any, 11.0% used WhatsApp, 7.0% social networks, 4.9% email, and 0.7% website business (CONAMYPE, 2018). Given that SMEs have the largest participation in the Salvadoran economy, their limited access to technological tools restricts the full use of electronic commerce benefits in El Salvador. When asking about SMEs’ internet tools, the 2017 National MYPE Survey found that 76.1% of SMEs business do not use any internet tools. , 11.0% used WhatsApp, 7.0% social networks, 4.9% email, and 0.7% website business (CONAMYPE, 2018)

Final Reflections

The e-commerce boom in recent years has undoubtedly brought opportunities and challenges. Even more, during the quarantine by Covid-19 it was vital for the supply of products and services, both in El Salvador and in the world. From the matrix for technology assessment of the implementation of e-commerce in El Salvador, it can be concluded that:

- Access to services such as the internet and a bank account is still a significant challenge for El Salvador, despite the advances in recent years. Furthermore, gaps in access to these services can contribute to widening social and economic inequalities, especially in the era of digitization. On the other hand, given the social context of violence and insecurity in the country, the Salvadoran population still mistrusts the exchange of goods and services on electronic platforms and the regulatory system to fear being victims of scams or misleading advertising. Thus, society elements (culture, trust in the social contract, etc.) and laws are crucial to taking advantage of new technologies.

- While having regulations for new technologies, it is necessary that they be holistic and practical legal frameworks. Despite having been an essential step for the new ICT era, the Electronic Commerce Law has relevant law gaps. It is not only about promoting commerce digitally but ensuring that users are protected against the negative impacts of technologies, such as cyber-attacks, scams, and theft of personal and business information.

- Although electronic commerce is based on intangible technologies, its effective implementation must be complemented with the development of enabling infrastructure. Thus, the transport infrastructure is vital to ensure that the logistics system is efficient in time and costs to provide users with their products in the expected time and with fair shipping costs and that sellers can guarantee deliveries on time.

- Finally, when introducing any technology, it is critical to train stakeholders and raise awareness of its benefits and potential risks. In electronic commerce, it has lacked to ensure that companies, especially small and medium-sized ones, have the skills to take advantage of these technologies’ potential. Besides, providing education to the population on issues such as financial inclusion has been neglected. For these efforts, all actors: Government, private companies, NGOs, research institutions, and others must create efficient and effective synergies.

References

Asamblea Legislativa. (2019, October). Ley de Comercio Electrónico. Retrieved February 26, 2021, from https://www.asamblea.gob.sv/sites/default/files/documents/dictamenes/B56411E0-3A7D-4147-85A6-40FAFE568479.pdf

Barrera, J. (2020, July 8). Pandemia obligó a negocios a entrar al ecommerce, pese a que no hay ley. El Mundo. Retrieved February 26, 2021, from https://diario.elmundo.sv/pandemia-obligo-a-negocios-a-entrar-al-ecommerce-pese-a-que-no-hay-ley/

CONAMYPE. (2018). Encuesta Nacional de la MYPE 2017. Retrieved February 26, 2021, from https://www.conamype.gob.sv/download/encuesta-nacional-de-la-mype-2017/

Del Carmen, G., Díaz, K., & Ruiz-Arranz, M. (2020, October). A un clic de la transición: Economía digital en Centroamérica y la República Dominicana. I-ADB. Retrieved February 27, 2021, from https://publications.iadb.org/es/un-clic-de-la-transicion-economia-digital-en-centroamerica-y-la-republica-dominicana

DIGESTYC-MINEC. (2020). Encuesta de Hogares de Propósitos Múltiples 2019. San Salvador. Retrieved February 18, 2021, from http://www.digestyc.gob.sv/index.php/temas/des/ehpm/publicaciones-ehpm.html

Fredriksson, T. (2017, April 27). E-commerce measurement @ UNCTAD. Retrieved February 26, 2021, from https://unctad.org/system/files/non-official-document/dtl_eWeek2017p25_TorbjornFredriksson_en.pdf

Institute for Economics & Peace. (2020, June). Global Peace Index 2020: Measuring Peace in a Complex World. Sydney. Retrieved February 27, 2021, from https://www.visionofhumanity.org/wp-content/uploads/2020/10/GPI_2020_web.pdf

Pastrán, R. M. (2019, November 4). Banca digital gana terreno en El Salvador, según estudio. El Economista. Retrieved February 26, 2021, from https://www.eleconomista.net/economia/Banca-digital-gana-terreno-en-El-Salvador-segun-estudio-20191104-0018.html

SSF. (November de 2015). Ley para facilitar la Inclusión Financiera. Retrived February 26, 2021, from https://www.ssf.gob.sv/descargas/Leyes/Leyes%20Financieras/Ley%20para%20facilitar%20la%20Inclusi%C3%B3n%20Financiera.pdf

The Economist Intelligence Unit. (2019). Global Microscope 2019: The enabling environment for financial inclusion. Retrieved February 26, 2021, from http://www.eiu.com/Handlers/WhitepaperHandler.ashx?fi=EIU_Global_Microscope_2019.pdf&mode=wp&campaignid=microscope2019

UNCTAD. (2019). UNCTAD B2C E-commerce Index 2019. Retrieved February 26, 2021, from https://unctad.org/system/files/official-document/tn_unctad_ict4d14_en.pdf

UNODC. (June de 2020). Desempleo, economía informal y crimen organizado: Junio, 2020 una aproximación desde el análisis sistémico El Salvador. Retrieved February 26, 2021, from https://www.unodc.org/documents/ropan/2020/Desempleo_economia_informal_y_crimen_organizado_una_aproximacion_desde_el_analisis_sistemico_El_Salvador_VFNL.pdf

Urquilla, K. (2021, February 21). Mipymes salvadoreñas pueden acceder a $3,000 para hacer comercio online, ¿qué deben hacer? El Diario de Hoy. Retrieved February 26, 2021, from https://www.elsalvador.com/noticias/negocios/mipymes-el-salvador-acceder-3mil-hacer-comercio-electronico/808017/2021/

World Bank. (24 de July de 2018). Logistics Performance Index 2018. Retrieved February 26, 2021, from https://www.worldbank.org/en/news/infographic/2018/07/24/logistics-performance-index-2018

World Bank Group. (2018). The Global Findex Database 2017. Washington, DC. Retrieved February 26, 2021, from https://globalfindex.worldbank.org/#data_sec_focus

Leave a comment